Retirement – Something we all anticipate for our future, but not something all of us plan for. According to the National Institute on Retirement Security, 77% of Americans fall short of their retirement savings goals for their age and income based on working to age 67.1 The U.S. Department of Labor indicates that less than half of Americans have calculated how much they need to save for retirement.2

At Indiana Farm Bureau Insurance, we want our members to not only retire, but to retire comfortably!

Retirement strategies, choose the right one for you

What’s a good strategy for planning a comfortable retirement? A good retirement strategy is one that fits you. Everyone has different goals and objectives: you may want to retire early, you may have health care costs you need to consider, you may have family members that require assistance – all sorts of things that may affect your ability to save and what you need and want to save for.

But remember, no retirement plan is the same. That is why it is important to work with a professional that can help you identify your goals and how best to reach them.

Indiana Farm Bureau Insurance agents and their team of professionals are willing to work with you to help you plan for your future. Whether you don’t plan to retire for many years, are looking for an early retirement strategy, a 401k retirement strategy or you are retiring soon and are unsure where to put your retirement money after retirement, we can help you develop a retirement strategy to meet your goals.

Many of our members appreciate our unique offense and defense retirement strategy. This strategy uses mutual funds from well-known fund companies that can provide great earning potential (offense) combined with fixed products from Indiana Farm Bureau Insurance to protect you from downturns in the market and protect your family in the event you don’t make it to retirement (defense).

What is offense defense strategy?

There are two major concerns most people have when it comes to their financial lives. The first is dying too soon and leaving their family without enough money to live comfortably. The second is living too long and not having enough money to live comfortably themselves.

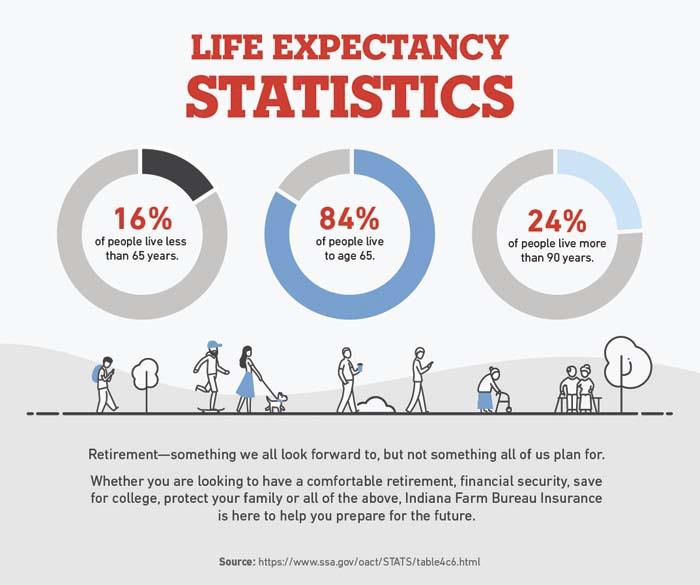

According to the U.S. Social Security Administration (SSA), about 84% of people live to age 65.3 That’s a great chance you will retire! The SSA also says that about 24% of people live past age 90. So statistically, that gives us two very different types of problems.

First, 16% of people die too soon and they need protection for their family in the form of life insurance so their family can maintain their standard of living. Second, 24% of people live past age 90 and the problem there is possibly not having enough money to afford to live comfortably (living too long).

Using our offense and defense retirement strategy, we can help you by providing a death benefit in case you are part of the 16% that doesn’t make it to retirement, while helping you save enough to retire comfortably when you do. And to help you afford to live comfortably into your 90s and beyond, we can provide a low-risk income source that provides a guaranteed income for life via our fixed annuity solutions, so you don’t have to worry about living too long.

We can help you utilize your retirement savings to provide protection for both concerns.

We call it offense and defense for a reason. On the offensive side, we help you select a portfolio of mutual funds to help you “score returns” with your savings. On the defensive side, we help you save for retirement in fixed products that are guaranteed to not lose money in a market downturn.

These products can also play defense by providing your family with a death benefit if you are part of the 16% of the population that does not make it to retirement. We have defensive products that can help with future health care costs if you become chronically ill. Offense to help you grow your savings, defense to protect those savings. Both sides help you save money for the future.

Our team at Indiana Farm Bureau Insurance will help you evaluate your goals and plans for your future. We have tools that can illustrate if you are on the right track to being able to afford your retirement dreams and help you understand how much you need to save to reach those goals.

We will work with you to find what is most important to you, help you identify how much risk you can tolerate in your investment portfolio and help you plan for your future while protecting your present.

What next?

You have dreams for your future. We will work with you to put a retirement strategy in place that will help you reach those dreams, while being flexible and allowing you to be in control. Find an Indiana Farm Bureau Insurance agent or contact your agent today and let us help you plan for the future, while protecting the present.

- New Report Finds Nation’s Retirement Crisis Persists Despite Economic Recovery. National Institute on Retirement Security. September 17, 2018. https://www.nirsonline.org/2018/09/new-report-finds-nations-retirement-crisis-persists-despite-economic-recovery/

- Top 10 Ways to Prepare for Retirement. Retrieved February 19, 2021. https://www.dol.gov/sites/dolgov/files/ebsa/about-ebsa/our-activities/resource-center/publications/top-10-ways-to-prepare-for-retirement.pdf

- https://www.ssa.gov/oact/STATS/table4c6.html

Investors should consider the investment objectives, risks, and charges and expenses of a fund carefully before investing. Prospectuses containing this and other information about the fund are available by contacting your registered representative.

Please read the prospectuses carefully before investing to make sure the fund is appropriate for your goals and risk tolerance. Securities & services offered through registered representatives of FBL Marketing Services, LLC 225 South East St., Indianapolis, Indiana 46202, 317/692-7497, Member SIPC. Individual must be a registered representative of FBL Marketing Services, LLC to discuss securities products. FBL Marketing Services is not an affiliate of Indiana Farm Bureau Insurance.

Inside Story is for educational and informational

purposes only. Inside Story is compiled from various sources, which may or may not

be affiliated with our family of companies, and may include the assistance of

artificial intelligence. While we strive to provide accurate and reliable

content, we make no warranties or guarantees about its completeness, accuracy,

or reliability, and are not responsible for the content of any third-party

sources or websites referenced herein. The inclusion of any content does not

establish a business relationship or constitute our endorsement, approval, or

recommendation of any third party. Testimonials and examples provided are for

illustrative purposes only and do not guarantee future or similar results or

outcomes, and may not consider individual circumstances, goals, needs, or

objectives. Inside Story does not provide legal, tax, or accounting advice. For

individual guidance, please consult a qualified professional in the appropriate

field.

Coverages

subject to policy terms, conditions, and exclusions. Subject to underwriting

review and approval.